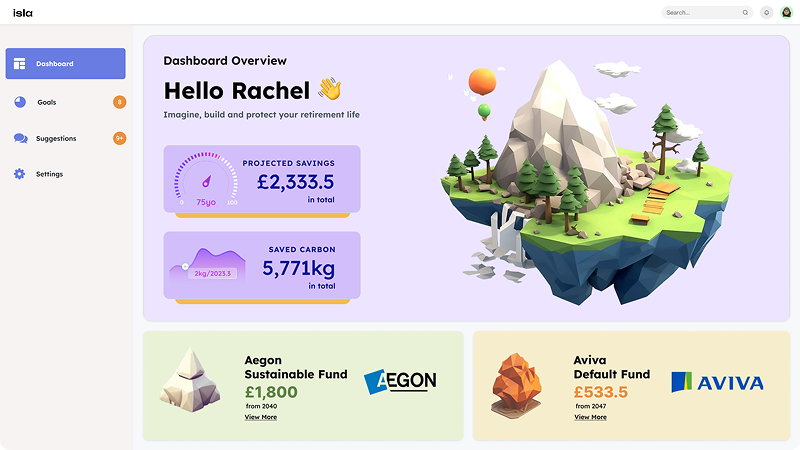

Isla

A planet-centric pension platform to help millennials visualise, build and protect their future

PARTNERS: Aegon UK, Royal College of Art

TEAM: Jiangke Chen, Prapti Mishra, Shruti Gunda, Yugendu Vyas, Zhiyu Huang

SCOPE

Empower people to take climate action through their pensions.

£3 trillion

approximate worth of UK pension funds

The Guardian

If we provide a personalised virtual space, depicting a user’s future and combine it with a user's choice of pension funds, then it will empower them to save for their future vision and make proactive choices for a sustainable switch.

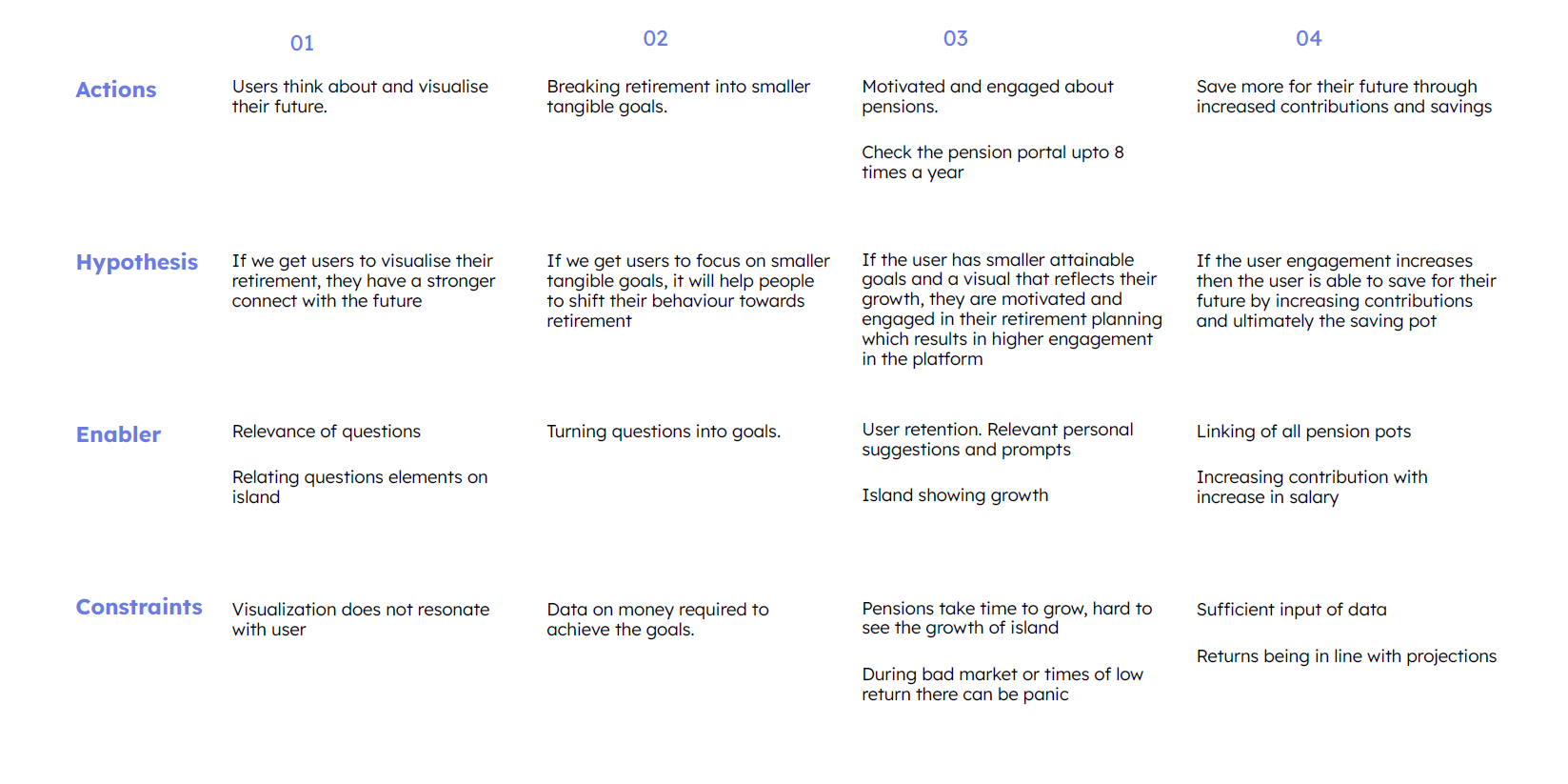

IDEATION

We brainstormed ideas that would address each of the key insights. We validated our hypotheses by concept sharing with potential users and industry experts which helped us narrow down to our top solution.

What is working:

Like that it’s relatable, empathetic and playful

Financial advice should be accessible to everyone

Gamification is engaging

Passive engagement is easier to adopt

Good to see climate risk next to financial risk

What can be improved:

Talk to me in my language

How can this information be made relevant to me?

Anchor it to people’s values

Be careful of transparency and greenwashing

SOLUTION

TESTING

We conducted A/B testing with 8 potential users and 5 Aegon experts. We used the feedback to test our assumptions, narrow down on a direction and refine our features.

Assumption:

Visualising their future will help people make more informed financial decisions.

Questionnaire:

“I prefer the narrative of Version 2, it sounds like a friend and I like the sense of humor.”

Fund choice:

“I found that Version 1 made it clear and easy to understand the difference between the two funds.”

PROTOTYPE

2. DISCOVER

Help Rachel clarify her future retirement goals through surveys and questions, and encourage her to envision a desirable future.

This helps people to connect the present and the future. Tackles present bias.

This makes it easier for them to make changes in their current behavior.

When people have a clear vision of their future, they're not just investing for their own wellbeing but also shaping the broader environment they'll live in.

4. PROTECT ✧

KEY MOMENT: Compare various pension plans and quantify their environmental impact to promote behavioral change.

Seeing the environmental impact of funds will drive people to choose the more sustainable one. Challenges status-quo bias.

Quantifying the relationship between money and climate impact.

Building connections between people, pension and the planet.

6. EMPOWER

Show collective efforts and create a sense of community.

Exploring other people’s islands to seeing what they are doing differently will motivate people to do better.

Interacting with islands can further engage people to take action.

What would success look like for Aegon?

More engagement with pension dashboards (up to 8 logins a year)

People save enough for retirement (currently need 6x times average pot)

Nurture a sense of collective power within their community of users, grow brand loyalty

Create awareness that our financial choices have consequences on the planet, meet strategic goal of reaching net-zero by 2030

£44 billion

value of 10% of working millennials pensions

23 million tonnes CO2e

saved per year if 10% if millennials switch funds

£3 trillion

could be invested in clean energy

300 million tonnes CO2e

saved per year if everyone in the UK switches funds

Low Engagement

Pensions are too boring and complicated

Lack of financial literacy

90% employees

have their work-place pension in the default fund

Pension Bee

38% adults

aren’t saving enough for retirement with housing costs in mind

GOV.UK

£88 billion

of UK pensions are invested in fossil fuels, coal and chemicals

Make My Money Matter

Focus on ROI

Care about returns more than sustainability

Care about short term goals more than long term

3. VISUALISE

AI-powered personalized creation of Rachel’s island to help her connect with a tangible future.

Visualising people’s future will help people make better financial decisions.

Through gamification and visualisation, show the impact of the choices people make today and the world tomorrow.

This solves the biggest challenges: disconnection, intangibility, lack of engagement, lack of connection

PARTNERSHIPS & STAKEHOLDERS

BUSINESS MODEL

For generating revenue, Isla has a subscription model which targets employers for platform access to their employees and secure commissions from promoting sustainable pension fund options. The business model will also be supported by surplus streams generated from premium paid features like 1:1 financial advice and AI scenarios.

COMPETITORS

There are a multitude of players along with Isla in the financial wellbeing and retirement planning industry. While these competitors range from major players to emerging startups focused on sustainability, Isla's unique proposition lies in its commitment to combining climate-conscious decision-making with a retirement plan that meets individual financial goals.

Making your pension green is 21x more powerful at cutting your carbon than giving up flying, going veggie or switching energy providers.

Make My Money Matter

Categorising key behaviours based on user interviews. Decided to focus on the passive and ambivalent types.

Projected environmental impact 🌍

AUDIENCE

This is Rachel.

She is a vegan to reduce her carbon footprint.

But she doesn’t know that her pension invests in fossil fuels.

Millennials like Rachel form the majority of employees, which is 60% of the UK pension market.

PROBLEMS

Disconnection

Between today and tomorrow

Between lifestyle values and financial choices

TARGET

OPPORTUNITY

Intangibility

Don’t like to think about growing old and retiring

Don’t see how their individual actions can make an impact on the environment

How might we help people visualise, build and protect their future?

FEATURES

1. ENGAGE

When Rachel starts her new job, she receives this from as a part of enrolment package and it nudges her to scan the QR code and start filling in the questionnaire.

Provide engaging materials from the first point of interaction with pensions.

Isla is a pension planning service. It focuses on visualising your future in the form of a personalised ever-growing island to increase engagement and financial literacy amongst millennials. Isla promotes sustainable investment and aims to motivate millennials to save for their future. It has a B2B2C model targeting working professionals.

JOURNEY

5. BUILD

Break down retirement into smaller, actionable goals and track progress to make the future more tangible.

See all your pension pots in one place.

Track goals which are created based on your quiz.

Forecasting your retirement time and retirement assets, as well as potential carbon savings.

AI suggestions, based on your basic information and goals.

AI chatbot offering advice on personal finances, pension management and retirement planning. Build financial literacy.

SUCCESS METRICS

What would success look like for Rachel?

Switches from the default to a sustainable fund

Increases her pension contribution (~15% in total)

Earns better returns (0.54 to 1.91% more -Morningstar)

Reads Isla’s educational content to enhance her financial literacy (50-80% completion rate)

POTENTIAL OUTCOMES

Projected financial impact 💷

£36,000

in an average pension in the UK

-

In July 2020, Smart Animated Pension Walkthrough was deployed in a beta trial to approximately 8,000 scheme members and it received a CSAT score of 87%.

-

A study by the International Longevity Centre reveals that, on average, UK savers improve their pension wealth by £30,991 by taking advice.

-

According to Morningstar, across 6 different categories of funds over a 5-year period, sustainable funds consistently outperformed their standard counterparts by 0.54-1.91%.

-

Savings rates soared by as much as 73% when people got fully and emotionally engaged in why they were setting money aside, according to a study conducted by Brad Klontz.

Assumption:

Seeing the environmental impact of funds will drive people to choose the more sustainable one.

SERVICE BLUEPRINT

19 tons CO2e

saved per person per year by switching to green funds

Isla operates in the financial well-being sector, The mission integration of our platform reinforces the triple bottom line - profitability, people, and the planet - by aligning our corporate strategy with environmental and social impact goals.

Isla’s market penetration strategy involves multiple key partnerships. Collaborations with pension providers will be essential to access financial data for user pensions and to integrate sustainable investment options. Financial advisors will serve as a customer channel, expanding Isla's reach within their client base.

When you enroll in a workplace pension scheme, your money is automatically invested in a default pension fund. This default pension fund is chosen to suit the average staff member. It's a one size fits all approach, where the investment solution doesn't necessarily line up with an individual’s values. Moreover, once the pension is set up, most people don’t look back, which means they end up staying in their pension scheme’s default fund whether they were planning to or not.